Calculating Your True Profit Margins in Ecommerce

Published on May 10, 2023 | 11 min read

Introduction

In the fast-paced world of ecommerce, understanding your true profit margins is the cornerstone of a sustainable and successful business. Many online sellers celebrate seemingly high sales numbers without realizing their actual earnings are far slimmer than they appear. This common mistake stems from overlooking hidden and indirect costs—leading to overestimated profits and unwise business decisions.

Whether you're a budding entrepreneur launching your first online store or a seasoned seller scaling your brand, accurately calculating your profit margins is crucial. It allows you to price products competitively, invest wisely in marketing, and ultimately grow a profitable business.

In this article, we’ll walk you through the comprehensive process of calculating your true ecommerce profit margins. We'll highlight common pitfalls, explore key cost factors, and share actionable tips to ensure you never underestimate your expenses again.

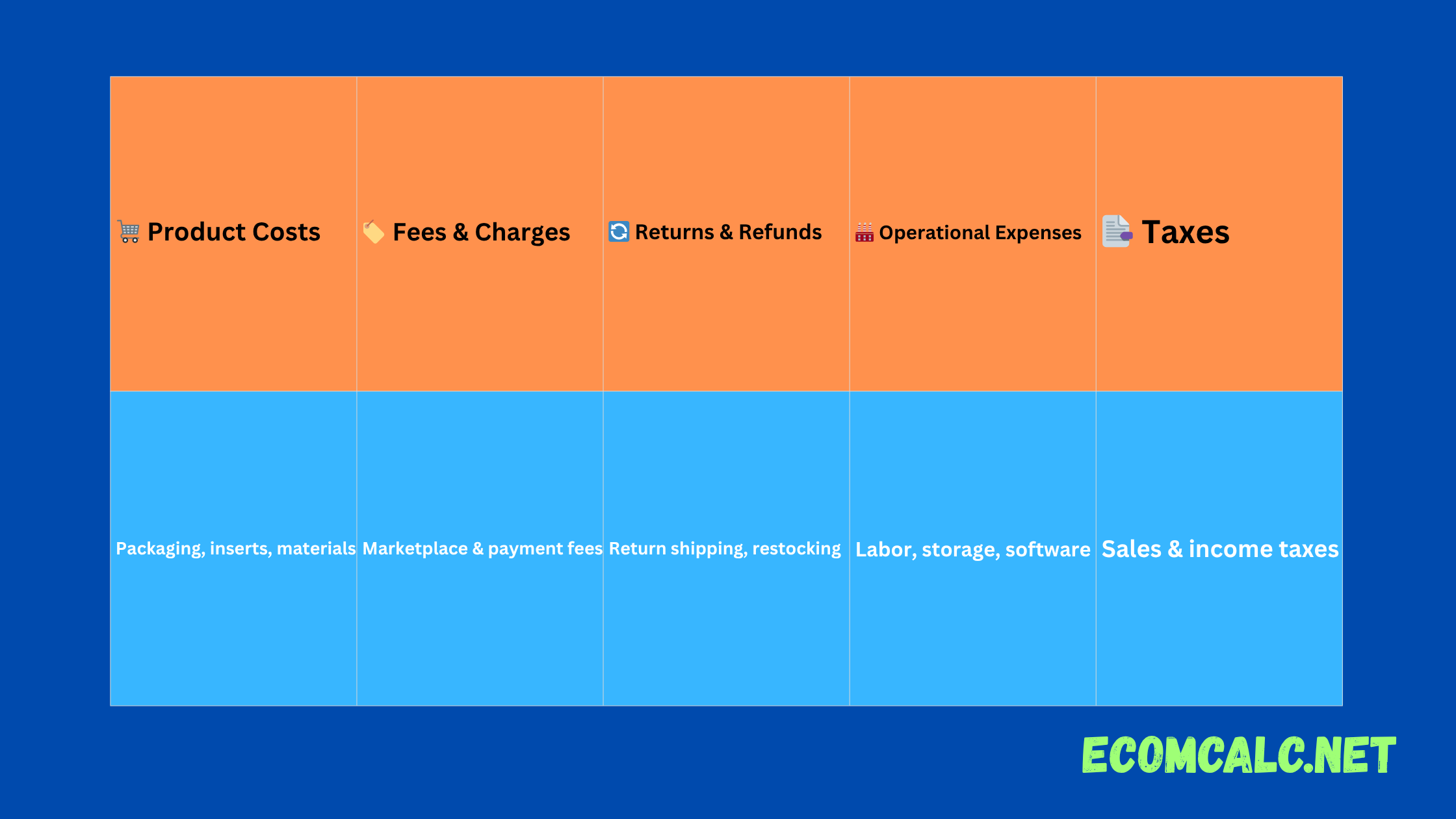

1. Start with All Product-Related Costs — Not Just Manufacturing

It’s tempting to focus solely on the price you pay to manufacture or source your products. But your real product cost is much broader.

Include Packaging, Inserts, and Labeling

When you purchase or produce a product, what else goes with it? Packaging materials such as boxes, bubble wrap, tape, and branded stickers add up quickly. Think about inserts like thank-you cards, discount coupons, or instruction manuals you include—these aren’t freebies, they’re costs that eat into your margins.

For example, if your product costs $10 to make but packaging and inserts add another $2, your actual product cost is $12—not $10.

Calculate Per-Unit Costs for Bulk Packaging

If you buy packaging supplies in bulk, calculate the exact per-unit cost by dividing the total cost by the number of units you package. This helps you pinpoint your true cost per product.

2. Factor in All Platform and Payment Processing Fees

Selling on ecommerce platforms or marketplaces means paying transaction fees that impact your bottom line.

Transaction and Commission Fees

Marketplaces like Amazon, eBay, and Etsy charge fees based on your product price or sales volume. Some deduct a flat fee per transaction, while others take a percentage of your sales price. These can range from 5% to over 15%, depending on the platform and product category.

Payment Processing Fees

Whether you’re accepting credit cards or digital wallets like PayPal or Stripe, payment gateways charge fees, typically around 2.9% + $0.30 per transaction. Ignoring these fees can dramatically overstate your profitability.

Advertising Costs on Platforms

Many sellers rely on platform-specific advertising such as Amazon PPC or promoted listings. Include these ad spends when calculating your profit margin because they are an essential part of your customer acquisition cost.

3. Account for Returns, Refunds, and Order Cancellations

Returns and refunds are a natural part of ecommerce but often underestimated in cost planning.

Typical Return Rates by Category

- Apparel and fashion: 20-30% returns

- Electronics: 5-10% returns

- Home goods: 2-5% returns

Research your category’s average return rate and set aside a percentage of your revenue to cover expected returns.

Costs of Processing Returns

Returns aren’t just about lost sales—they also involve restocking fees, shipping costs, and potential product damage. Factor these into your cost calculations.

Handling Refunds and Order Cancellations

Refunds often involve additional fees (e.g., marketplace restocking fees) or lost shipping costs. Order cancellations, especially late cancellations, may also incur fees or wasted shipping expenses.

4. Include Operational and Overhead Expenses

Beyond direct product and sales-related costs, your business incurs many operational expenses that need allocation.

Warehousing and Storage Costs

If you use a fulfillment center or warehouse, storage fees may be charged monthly or based on volume. These fees increase as inventory grows.

Labor and Staffing Costs

Whether it’s a dedicated fulfillment team or customer support personnel, labor costs must be incorporated on a per-product or per-sale basis.

Software and Subscriptions

Subscription fees for ecommerce platforms, inventory management tools, accounting software, and marketing automation tools add up and should be allocated per item or per month.

Packaging Labor and Shipping Materials

The labor to package orders and the cost of shipping labels, boxes, tape, and cushioning materials need to be factored into each sale.

5. Calculate After-Tax Profit — Don’t Forget Taxes

Many sellers overlook taxes when calculating profit margins, which can lead to unpleasant surprises.

Sales Tax

Depending on your region, sales tax may be collected and remitted, but sometimes this responsibility falls on the seller, affecting net profit.

Income Tax and Corporate Tax

Your business income is taxable. While you might not remit taxes immediately, setting aside a percentage of your profit for income tax helps maintain accurate profit projections.

Tax Deductions

Remember that some costs like advertising, software subscriptions, and shipping expenses are tax-deductible. This can offset some tax liabilities but requires careful bookkeeping.

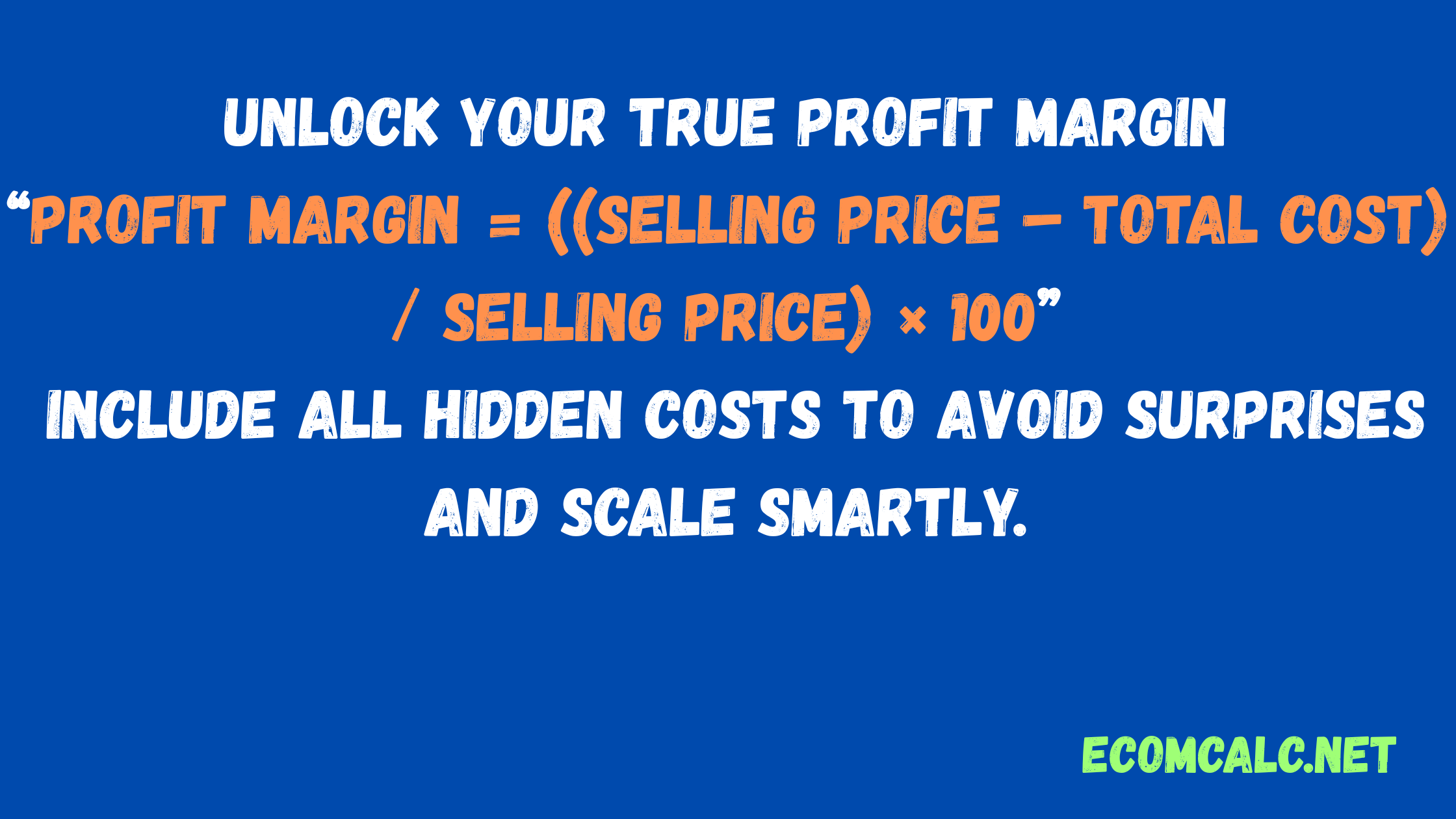

6. How to Use These Calculations: The Ecommerce Profit Margin Formula

Here’s a simple formula you can adapt to calculate your true profit margin per product:

Profit Margin = ((Selling Price - Total Cost) / Selling Price) × 100

Where:

- Selling Price = The final price your customer pays (including shipping if you pass that cost on)

- Total Cost = Sum of all product costs + platform fees + payment processing fees + advertising spend + returns cost + operational overhead + taxes

7. Why Most Sellers Underestimate Their Costs by 15-20%

Many sellers look only at manufacturing and shipping costs and forget:

- Packaging and inserts

- Platform commissions

- Advertising and marketing spends

- Return and refund costs

- Storage and labor overhead

- Taxes

This oversight leads to inflated profit expectations and poor pricing strategies that could hurt cash flow and growth.

8. Practical Steps to Track Your True Profit Margins

Use Ecommerce Calculators and Software

Online ecommerce profit calculators help automate complex fee structures across different marketplaces. Accounting tools like QuickBooks or Xero integrated with your store can provide real-time margin insights.

Regularly Audit Your Costs

Costs evolve: advertising rates increase, platform fees change, return rates fluctuate. Schedule regular reviews to keep your numbers current.

Factor in Seasonality and Scale

During peak seasons, advertising and shipping costs may spike, impacting your margins. Likewise, scaling may reduce some per-unit costs (bulk packaging, shipping discounts) but increase others (labor).

9. Tips to Improve Your Ecommerce Profit Margins

Once you know your true margins, you can take actionable steps to improve them:

- Negotiate with suppliers and shipping providers for better rates

- Optimize packaging to reduce materials and shipping weight

- Minimize returns by improving product descriptions and images

- Use targeted advertising to reduce wasted ad spend

- Automate operations to cut labor costs

- Increase prices strategically when the market allows

Conclusion: Profit Margins Are the True Measure of Ecommerce Success

Sales figures are important, but profits are what keep your business alive and growing. Accurately calculating your true ecommerce profit margins takes diligence and detailed cost tracking but pays off with smarter pricing, budgeting, and growth strategies.

Avoid the common trap of underestimating costs by at least 15-20%. Incorporate all hidden fees, operational overhead, taxes, and return costs into your calculations. Use tools and regular audits to keep your numbers precise.

By mastering profit margin calculation, you’ll make better business decisions, improve your cash flow, and build a sustainable ecommerce brand that thrives long-term.